What is a good banking experience?

That is a broad question whose answer is going to vary from one customer to another, depending on the individual’s needs. Generally, customers’ satisfaction with their bank increases if they feel supported during challenging economic times. There is a lot that goes into a customer’s overall experience, from opening up their first account to managing their account to applying for loans.

However, there is one sure-fire wire to help make your customers’ banking experience better, and that is to make every customer transaction smoother: effortless and easy for the customer. If you can speed up your cash handling process, decrease machine downtime, and optimize for mobile banking, you can guarantee a good banking experience.

Whether in-person or online, regardless of location, here is how you can make your customer transactions smoother – and guarantee your customers will stay your customers.

Speed Up Cash Handling

Despite the proliferation of digital sales, online currency transfers, and mobile app transactions, cash is still used by many Americans for everyday transactions. Fortunately, the technology behind cash handling machines has come a long way, so speeding up the cash handling process can be made easy.

Your customer experience is the impression your customers have of your institution. If your customers are able to quickly and safely complete their banking needs with your organization, their customer experience will be positive.

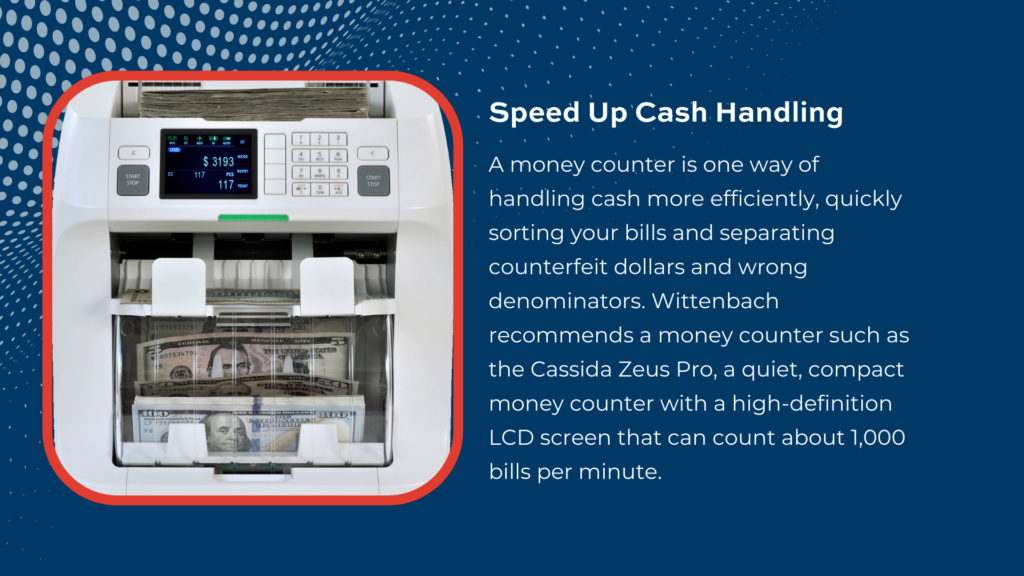

A cash discriminator is one way of handling cash more efficiently, quickly sorting your bills and separating counterfeit dollars and wrong denominators. Wittenbach recommends a money counter such as the Cassida PRO’s Zeus, a quiet, compact money counter with a high-definition LCD screen that can count about 1,000 bills per minute.

The Cassida PRO’s Zeus has a counting speed of about 1,000 bills per minute. Despite that, it remains quiet, ensuring your branch is not disrupted and overwhelmed by sound. It is compact enough to be transferred from one space in your branch to another, without requiring any extra equipment.

The two-pocket design of the Zeus means that counterfeit bills or incorrect denominations will not hold up the counting process. Instead, bills with issues are deposited in the upper pocket, allowing for a closer in-person inspection by one of your employees. Meanwhile, bills without any issues are deposited in the lower pocket.

A free standing solution such as a TCR or Teller Cash Recycler, can also handle large quantities of bills while detecting counterfeit bills. The Hyosung Innovue MS500 TCR combines a bill counter, small vault, and cash dispenser solution in one package.

Decrease ATM and ITM Downtime

While ATM and ITM devices may occasionally break down or require maintenance, this can still be a huge inconvenience for your customers, especially if this occurs during normal business hours. No one wants to wait in line during their lunch break just to use an ATM for a simple financial transaction.

One way to counteract that is by having enough ATM and ITMs at each of your locations. Depending on your financial institution’s needs, location, and size, you may have a drive-through ATM, an in-lobby ATM, a through-the-wall ATM, or a combination of these offerings. A single non-working ATM is much more frustrating when it is your only ATM on-site, or when it requires a customer to go into your location instead of using the exterior ATM. This issue is made even worse if they have to go to a different branch location to complete their transaction.

Another way of counteracting ATM downtime is through a professional managed services offering. Our managed services offering assumes responsibility for securing and optimizing your ATM and ITM network. We can conduct status monitoring, perform diagnostics, and implement patch management, ensuring your network is secure. Our reports provide valuable data such as cash loads, transaction volume, and software and hardware data.

Optimize for Mobile Banking

Your online and mobile banking offerings are key to both attracting and retaining customers. The growth of mobile banking is not slowing down, with a prediction that online and mobile banking users will exceed 3.6 billion by 2024.

Along with the basics of account management, consumers have other mobile banking needs. They may want to find an ATM nearby, so having an ATM locator built into your banking app is important. Provide them with filtering options, so they can see all ATMs within a specific mile radius, or only the ATMs that are available outside of normal business hours.

Bill payment options, along with a mobile check deposit option, are also important. However, customers want to do more than pay their rent or utilities. They also desire peer-to-peer payments, giving them a quick, instant option to repay friends and family.

Transforming Branches and Making Customer Transactions Smoother

There are many ways to make customer transactions smoother. However, it is not always easy to determine which solution(s) is right for your financial institution. The size of your institution, number of locations, customer needs, and security concerns should all come into consideration when deciding what technology and services to implement to make customer transactions smoother.

That is where a trusted partner like Wittenbach comes into play. Since 1974, we have been serving customers throughout the East Coast and Midwest. Our cash handling solutions, combined with our physical and electronic security solutions, have been transforming financial institutions. By putting the customer at the center of each transaction, we are helping our clients shift how they service customers. With over 500 current customers and over 15000+ branches serviced, we are confident we can help make customer transactions smoother for your financial institution.

Give us a call at (410) 667-6400 or send us a message to have one of our representatives contact you. You can also schedule a visit to our solutions center, where you can explore how to reduce your operating costs, discuss proven solutions that other financial institutions have successfully implemented, and find more ideas on how to survive and thrive in the challenging financial industry.