As cash recycling functionality is added to a growing number of new ATM and ITM models, it is important for your financial institution to understand how this process works. Cash recycling automates the depositing and dispensing of currency, adding a layer of efficiency to normal ATM or ITM functions in that it checks for counterfeit money and dispenses bills from the same cassette into which cash was initially input.

Financial website Bobsguide says, “Enter cash recycling at ATMs. Cash recycling isn’t actually new. The first cash recycling ATM was implemented in Japan in 1982 and is a more established phenomenon in BRIC countries such as China (2002) and India (2014). It is, however, arguably the most innovative development in recent years for self-service terminals. The premise is simple: customers and businesses alike can deposit cash at an ATM which will be automatically recycled for immediate use.”

In addition to banks and credit unions, cash recycling ATMs and ITMs can be a game-changer in other businesses, too: grocery stores, bars and restaurants, sporting and concert venues, and other retail establishments in which cash transactions are prevalent. Wittenbach has experience in all of these settings, and our suite of Hyosung cash recycling ATM and ITM machines can help your business make the most of your cash recycling technology.

What are the benefits of ATM cash recycling?

- Innovation: Although the concept of cash recycling is not new, its prevalence grows as ATM and ITM machines’ capabilities evolve. By deploying cash recycling functionality across your branches, it means you are likely using (or considering purchasing) a new ATM or ITM fleet, and optimizing your available cash management technology. Despite a global reduction in cash spend and a rise in digital payments, the need for cash and efficient ATM transactions is not going away.

- Reducing cash-in-transit (CIT) provides the opportunity to reduce external costs. Although armored car services are a necessary expense, a cash recycler means that your currency is replenished, which reduces the number of trips required by your CIT provider. Fewer CIT visits to your branch also means a decreased security risk; banks and credit unions become more vulnerable to security breaches when cash is transferred and ATMs are open. Software provider Euronet adds, “And reducing the number of CIT visits and potentially reducing the number of service calls can mean lower carbon emissions directly related to ATM fleet operations. Overall, it’s a win-win-win for financial institutions, customers, and the environment.”

- Automated cash handling means a reduction in human error. An ATM or ITM cash recycler accepts currency deposits, while simultaneously checking for counterfeit notes. It then dispenses currency from the same cassette. This process is fully automated, removing the element of human touch and the risk of counting errors, no matter how tenured your teller may be. A cash recycler is also significantly more adept at identifying fraudulent currency than a teller employee. Tracking Advice says, “An ATM detects money using its ‘electronic eyes’ that analyze the cash to ensure it is printed with magnetic ink. Moreover, an ATM can scan money bills to check if they match the authentic bills’ specifications.” These specifications include security threads, a 3D security ribbon, a watermark, specific paper quality, colored fibers in the bills, texture, and print quality.

- Reducing labor costs is a benefit especially relevant in the retail space. Cash handling giant Loomis advises, “Start-of and end-of-day cash-handling procedures can be highly inefficient, especially for multi-register businesses. When employees have to wait in line to check-in and check-out their tills, that’s valuable time your business is losing that could be spent assisting customers and making sales. And if your operation is large enough to require full-time cash handling staff, this is a significant use of resources that could be allocated elsewhere. With a cash recycler solution, the process is almost 100% automated, and time spent on cash room tasks is drastically reduced.”

What are the benefits of teller cash recycling?

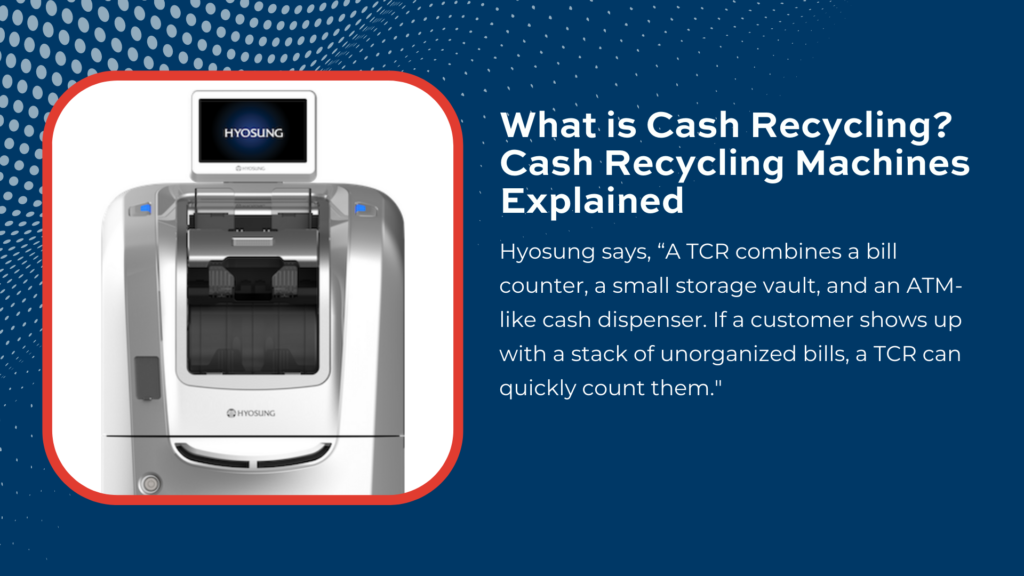

Cash recycling technology not only applies to the ATM world, but to tellers’ desktops as well. A teller cash recycler or “TCR” is a miniature vault that sits on the teller’s side of the glass, and performs the following functions:

- Accepts cash deposits from tellers

- Screens for counterfeit bills

- Sorts bills by denomination

- Counts bills and verifies the total amount

- Safely stores the bills

- Dispenses bills when needed

Renowned manufacturer and Wittenbach partner Hyosung says, “A TCR combines a bill counter, a small storage vault, and an ATM-like cash dispenser. If a customer shows up with a stack of unorganized bills, a TCR can quickly count them. Should another customer need to cash a check, the teller cash recycler can handle that, too. The latest designs are incredibly accurate for counting even old or damaged bills and can detect counterfeits easily.”