At Wittenbach, we often like to talk about advancing technologies that can help increase banking effectiveness and efficiency. However, any time new technology is introduced new security concerns emerge. This is especially true when it comes to fraudulent banking activities. For example, imaged ATMs could open doors for new types of fraud, such as increased attempts to deposit counterfeit checks. It’s important for financial institutions, as well as companies with a focus in banking security to become aware of deposit fraud.

Deposit Fraud Terminology

Deposit fraud has many elements to it, such as the actors involved and information directly found on the check. Before defining deposit fraud, it’s important to understand the terms relating to it:

- The Customer: a person that has a bank account set up with a financial institution.

- The Drawee: a party, typically a financial institution, that is required to pay out the money when a check or draft is presented. The drawee is usually the payer financial institution.

- The Drawer: a person writing a check. In a sense, they are also the customer as mentioned above, but they are specifically a customer of the drawee.

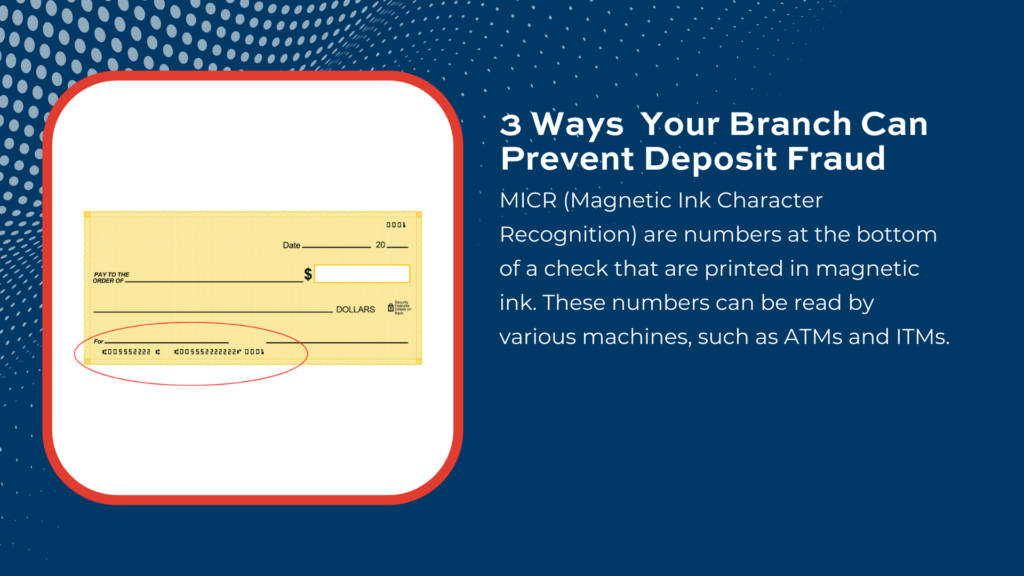

- MICR (Magnetic Ink Character Recognition): numbers at the bottom of a check that are printed in magnetic ink. These numbers can be read by various machines, such as ATMs and ITMs. The numbers usually are encoded with the name and address of the drawee financial institution, the account number, and the check number. Once the check is written, the dollar amount ends up being added to the MICR lines while the check is processed.

- The Payee: a party entitled by the creation of a draft or check to receive funds from the written check that came from the drawee. The payee, in some cases, can also be defined as a scammer, since they are the ones trying to get the fraudulent money in their pockets.

- Check Presentment: this is the delivery of the check or draft that is presented to the drawee for payment.

With this background knowledge, let’s review what the overall process of deposit fraud is before reviewing three solid solutions that can help prevent it.

Deposit Fraud

Depositing a check, in-person, is quite easy. The user will walk up to their bank’s ATM or ITM, and select the ‘deposit’ function on the screen. The user will then be prompted to insert their check into the slot where cash or checks can be inserted to. Once the check is in the machine, a message will appear on screen saying whether or not the user’s check successfully was deposited. This process can allow for scammers to insert hardware into the banking machine, or software that can detect the user’s information, and steal it for their own future use.

Deposit fraud includes checks written without sufficient funds in the customers bank account to cover them. It also covers checks that were written to take money out of closed accounts. The act of conducting deposit fraud means that a customer is writing a “bad check”, which can be grounds for a civil lawsuit. In other, more serious cases, some of these bad checks can be the basis for criminal action.

This fraudulent activity can also be done remotely, which means the scammer gains access to a customer’s bank account. When doing this, the scammer can begin to deposit fraudulent checks remotely, without the customer knowing. In some cases, the scammers can ask the victims to withdraw their funds and send them back through a third-party service that specializes in money transfers. This can also result in criminal action against the scammer.

Another form of deposit fraud that occurs across the country is identity assumption. This occurs when scammers gain personal information, such as a customer’s name, address, financial institution account number, phone and social security number, as well as home and work addresses. With this information, they are able to misinterpret themselves as a real customer. When they are able to do this, they can then create fake transactions and write checks that are fraudulent.

There are various methods that customers, as well as financial institutions, can use to combat deposit fraud as a whole. Banks could introduce ATMs that feature biometric scanners. As for customers, they can also turn on push notifications on their mobile devices for each and every transaction that occurs under their bank account. This can make customers more aware of their own transactions and pay attention to when their bank account is being used.

It’s always important to put the customer first, but without deposit fraud guidance, bank branches won’t be able to assist said customers to the fullest of their abilities when it comes to deposit fraud. With that, let’s discuss some solutions that financial institutions can use to prevent deposit fraud.

Solutions to Prevent Deposit Fraud

There is not one concrete way that financial institutions can prevent deposit fraud. However, there are three ways that, when used simultaneously, can empower your financial institution to prevent fraudulent deposits. These three ways are transaction analysis, check stock validation, and signature verification.

Transaction Analysis: a process of examining a customer’s bank transactions to find out if any deposit fraud or other issues are affecting the account. Through this action, banks can reduce fraud by analyzing every check, ACH payments, debit and credit card payments, and loan transactions. In some banks, this process can be done manually, but thanks to evolving technology, softwares have been developed to conduct transaction analysis.

Check Stock Validation: a process that financial institutions conduct to verify pre-printed (stock) details that are found on business and personal (customer) checks. It analyzes elements, such as headers, check numbers, account holder name, and contact details to ensure that the check that is trying to be processed is free of any fraudulent activity.

Signature Verification: a process used by financial institutions to validate that the identity signed on a check matches that of the account holder. There are many softwares that can complete this process by sweeping through a financial institution’s files to compare every signature on an account holder’s processed checks to the checks that are flagged as fraudulent.

Financial institutions that focus on combating check fraud by using these three processes will earn the trust of their customers and provide an overall safer banking experience.

In addition, there is a piece of equipment that can also detect fraud. The Hyosung 8300 series of ATMs and ITMs come with fraud detection software, such as being able to tell if a skimming device was installed into the machine. Hyosung also has recently decided to integrate TrueChecks® into their machine software platforms. This will give Hyosung’s line of self-service banking machines to be able to check several types of fraudulent deposits.

The TrueChecks® software being implemented into an already safe and secure line of Hyosung ATMs/ITMs is sure to prevent fraud at a higher rate than ever before.

In Conclusion

Deposit fraud is here to stay thanks to advancing technology in the banking industry. However, financial institutions can stay ahead of scammers by reviewing customer identification thoroughly and by contacting customers to warn them that they need to keep their personal information private to avoid potential fraud.

Here at Wittenbach, we aim to show our customers that we care for them. We can provide your company with top-of-the-line physical and electronic security systems to help you lower costs, reduce risk and provide better service to your customers. Let us help you prevent deposit fraud to show your customers that you care for them too.

Contact Wittenbach today for any questions you may have, such as scheduling a tour or getting a quote. Let us show you the measurable difference by working with us today.