BLOG

Protecting Your ATM Fleet with Modern Electronic Security Measures

ATMs play a vital role in everyday banking, giving customers fast and convenient access to their funds. Unfortunately, their accessibility also makes them frequent targets for criminal activity. The good news: today’s ATM hardware can be equipped with advanced electronic security technologies that significantly enhance protection, reduce risk, and promote customer confidence. Below is an overview of how these solutions work together to safeguard your machines and the people who rely on them.

- Alarm the Top Section of the ATM

The upper portion of an ATM houses essential components – communication modules, control boards, and system electronics. Installing an alarm in this area provides critical early detection if tampering occurs. This helps deter criminals who rely on going unnoticed, minimizes downtime, and supports rapid response to potential threats.

- Add Sirens and Strobe Lights for Rapid Deterrence

Integrating sirens and strobe lights into the top section delivers strong audible and visual deterrence. When triggered, bright strobe lights draw attention to the ATM while loud sirens disrupt and discourage criminal activity. These measures greatly increase the likelihood of detection and timely intervention. - Enhance Camera Coverage for Increased Visibility

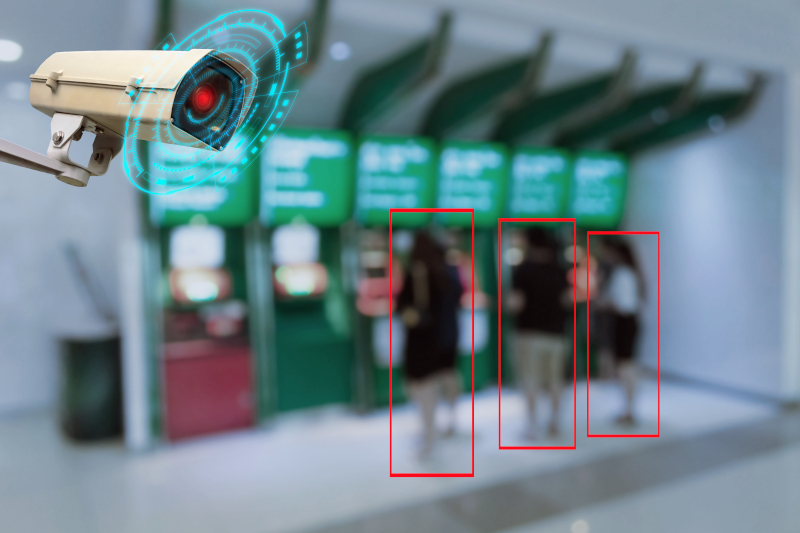

High-quality, properly positioned surveillance cameras remain one of the most effective crime-prevention tools. Improved camera coverage reduces blind spots, enhances the ability to identify suspicious behavior or individuals, strengthens post-incident evidence collection, and increases customer confidence when using the ATM. - Use Card Readers With Advanced Anti-Skimming Technology

Skimming continues to be one of the most common forms of ATM fraud. Upgrading to card readers with advanced anti-skimming technology helps protect consumers by detecting and disrupting unauthorized skimming devices, making data theft significantly more difficult, and alerting security personnel to tampering attempts—all contributing to safer, more secure transactions.

By combining these modern electronic security measures, financial institutions can create a far more secure ATM environment while dramatically reducing the risk of criminal attacks. Continued investment in ATM protection not only safeguards valuable assets but also reinforces trust, ensuring customers feel safe every time they access their money.

For more information about equipping your ATM fleet with advanced electronic security technologies, please contact your Wittenbach account manager