When your clients use ATM or ITM machines at your financial institution, which words would you use to describe the ideal transaction? Reliable, user-friendly, smooth, secure, and modern are all descriptors that likely come to mind. At Wittenbach, we understand that providing and protecting that experience is critical to the success of your branches. Below are several tips to keep your ATM/ITM fleet online and functioning at its prime.

Setting the stage: ATMs, ITMs, and uptime, oh my!

Automated teller machines, or ATMs for short, have offered a convenient means of dispensing cash since the 1960’s. Since then, ATMs have become synonymous with the process of a transaction outside of the four walls of a traditional bank or credit union; they can appear outside branches, in convenient drive-thru lanes, in walls, or freestanding in businesses where cash is required. The setting can range from restaurants and retail shops to beauty salons, tattoo parlors, sporting and concert venues, parking structures, and many more. The modern ATM has evolved not only to dispense cash, but to perform other important functions such as accepting deposits, recycling cash, and even processing bill payments.

ITMs, or Interactive Teller Machines, take the ATM experience even further along its digital journey. ITMs can perform virtually all of the same functions as ATMs, and although pricier per machine, they offer an advanced personal touch and extended hours with video teller capabilities.

“Uptime” is a critical metric in the life of an ATM/ITM fleet, as it most commonly refers to the rate at which each machine is online and ready to transact with clients. The industry standard for ATM/ITM uptime is 98-99%, according to ATM Marketplace. The site also recommends considering not only uptime, but transaction failure rate, as an indicator of your fleet’s health. An ATM/ITM can be online, but it matters just as much that a client can navigate all the way through each function without issue or interruption. ATM Marketplace says, “As their customers increasingly migrate from the teller channel to self-service transactions, using multi-function ATMs for transactions previously handled by tellers such as high-value cash withdrawals, fund transfers, bill payments and cash or check deposits, [financial institutions] must ensure their ATM channel is available 24×7 to deliver services to customers.”

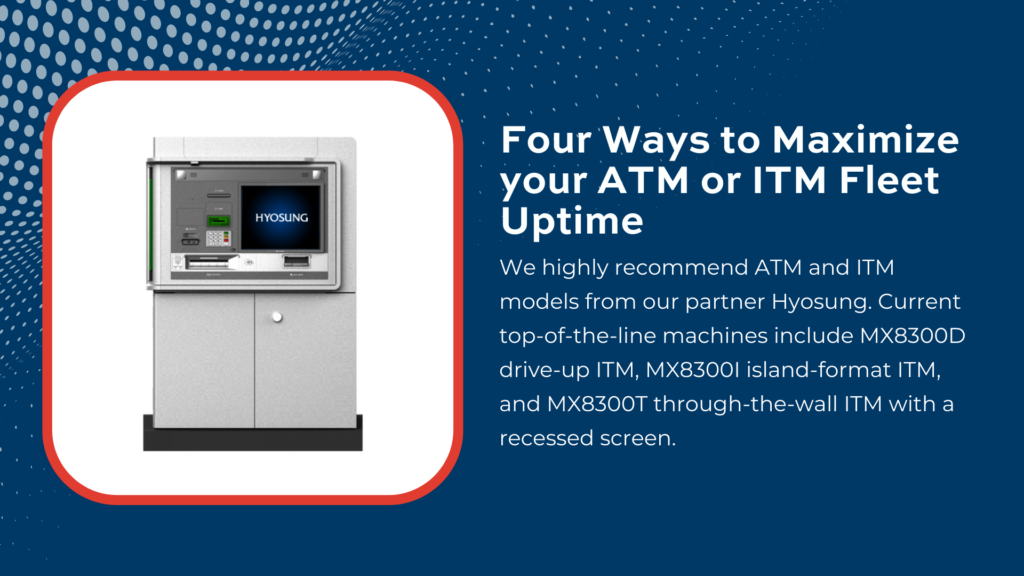

Since ATMs and ITMs are one of Wittenbach’s four foundational pillars, we have a team of dedicated experts who can advise on best practices that will ensure your fleet’s optimal uptime. Additionally, our partnership with ATM/ITM manufacturer Hyosung means that we are intimately familiar with industry trends and common issues, and can help your financial institution to prevent incidence of downtime or transaction failure.

Ways to maximize ATM and ITM machine uptime

- Anti-skimming features on the latest ATM and ITM models protect users of the machine from criminals who seek to illegally obtain their personal data. A camouflaged skimming device on an ATM/ITM, gas pump, or other POS terminal transmits data either by magnetic stripe, by chip, or wirelessly. As an example of preventive measures that can keep your fleet onine, Hyosung ATM/ITMs’ anti-skimming features come standard, offering protection by jamming the signals of any potential malicious hardware. When the unit is protected, uptime is preserved and customers may continue their transactions. Atmia offers additional methods of physical hardware security, saying, “…the cash should be physically secured against explosions, safe cutting and the ATM should be bolted down against physical removal.”

- Software maintenance is just as important as hardware maintenance on an ATM or ITM machine. By staying on top of regular software updates, especially during times of lower traffic, your fleet is protected from “bugs” and potential security threats.

- Use your ATM or ITMs’ existing cash recycling features also promotes fleet uptime, as it drastically reduces the risk of running out of dispensable cash. By using internal cassettes to redeploy usable currency back to clients who request cash withdrawals, your machines rely far less on traditional cash-in-transit (CIT) armored car services to replenish bills. Properly stocked machines mean that your clients can consistently access the cash they need, at any time.

- Wittenbach’s Managed Services offering relieves the weight of ATM and ITM administration from your in-house IT group across your fleet, allowing their time to be spent on other important tasks. We ensure that any ATM/ITM emergencies are immediately addressed and that software patches are installed at times that will not interrupt service. Robust default and custom reporting allows you to see the results of these efforts on-demand.

Burroughs explains concisely, “Many managed services firms can also take their services to the next level with their full lifecycle management offerings. In addition to repair and replacement functions and assistance with patching, firms can also step in to deliver comprehensive fleet management services to test, schedule, and implement software patches; help select OEM updates throughout your fleet; and help monitor and remediate issues via their remote fleet management tools.”

ATM/ITM models that Wittenbach recommends

As highlighted in earlier blog posts, we highly recommend ATM and ITM models from our partner Hyosung. Current top-of-the-line machines include MX8300D drive-up ITM, MX8300I island-format ITM, and MX8300T through-the-wall ITM with a recessed screen. All models contain four cash-recycling cassettes, accepting cash in and out in large quantities. Advanced sunlight-viewable touchscreens, high-quality built-in cameras and microphones, and user-friendly software that runs on current Windows 10 technology are just a few of the additional ways these machines stand out from the rest of the market.

With these best practice tips in your figurative pocket, your financial institution can reap the rewards of optimal ATM/ITM functionality: the highest possible percentage of uptime, reduced transaction failures, collection of the most transaction fees if you charge them, and most importantly, happy clients who return to your location again and again. As your branches strive toward reliability, accessibility, and modern technology, contact Wittenbach when further ATM/ITM questions arise. We are ready to support your transformation to best-in-class!